Où investir : les meilleures villes de France pour un investissement locatif réussi

"Où investir" est la question que se pose les investisseurs qui souhaitent lancer un nouveau projet d'investissement locatif. En effet, l'endroit où mener son projet a un impact sur sa réussite. Investir dans l’immobilier locatif c’est l’opportunité de se constituer un patrimoine solide et une garantie de rentrée d’argent mensuelle. Aussi, pour les investisseurs, qu’il s’agisse d’un premier achat ou d’un achat multipropriétaire, l’immobilier constitue un placement rentable et avantageux. Seulement, où investir ? Réponses !

Un investissement locatif

rentable en 2026

Où investir : notre comparatif et notre avis !

L’achat d’un bien immobilier pour des fins locatives dans une grande ville constitue a priori l’assurance de la rentabilité. En effet, les métropoles françaises concentrent l’emploi. Ce sont les sièges des plus grandes universités du pays. Ainsi, que vous choisissez d’investir dans un studio d’étudiant, dans un appartement de 2 pièces pour un jeune actif, dans une maison entière pour une famille, faire une offre dans une grande ville optimise vos chances de pouvoir louer votre bien immobilier facilement !

Pour vous aider à choisir la meilleure ville où faire son placement cette année, Investissement Locatif vous dresse le comparatif des localités où investir en 2024.

| City | Price per m2 | Average salary / inhabitant (net) | Unemployment rate | Proportion of students |

| Paris | 10 611 € | 4 127 € | 9% | 14% |

| Lyon | 4 911 € | 2 944 € | 7,80% | 30% |

| Marseille | 3 538 € | 2 532 € | 9,90% | 6% |

| Bordeaux | 5 078 € | 2 728 € | 7,30% | 23% |

| Lille | 3 675 € | 2 579 € | 8% | 32% |

| Nantes | 3 961 € | 2 720 € | 6,10% | 20% |

| Rennes | 4 077 € | 2 586 € | 6% | 31% |

| Toulouse | 3 646 € | 2 719 € | 7,40% | 28% |

| Rouen | 2 725 € | 2 585 € | 8,40% | 27% |

| Metz | 2 330 € | 2 426 € | 7,20% | 19% |

| Nancy | 2 360 € | 2 603 € | 7,20% | 50% |

| Reims | 2 938 € | 2 453 € | 8,10% | 16% |

| Saint-Etienne | 1 726 € | 2 306 € | 7,70% | 15% |

| Grenoble | 2 844 € | 2 696 € | 6,40% | 37% |

| Montpellier | 3 689 € | 2 377 € | 21,30% | 27% |

| Villeurbanne | 3 832 € | 2 507 € | 7% | 3% |

| Orleans | 2 580 € | 2 528 € | 8,40% | 16% |

| Région Ile de France | 6 718 € | 3 353 € | 9,70% |

5% |

Depending on the type of rental purchase desired, you should choose between the above criteria:

- pour un studio ou un 2 pièces, il faudra se concentrer sur les plus grandes proportions d’étudiants

- pour une maison ou un appartement de standing, on se concentrera davantage sur le salaire moyen par habitant combiné au faible taux de chômage

- les budgets plus serrés examineront le prix au mètre carré en comparaison de la proportion d’étudiants

- pour les achats plus conséquents, il convient de vérifier le taux de chômage qui est en lien direct avec le taux de vacance

Où investir : quelques aperçus des grandes villes de France où mener son projet !

Choisir la ville où faire une offre si vous souhaitez louer dépend généralement des atouts que la localité a à offrir. En fonction du projet, le choix de la ville peut aller des plus grandes métropoles aux municipalités ayant une forte concentration étudiante. Faire un placement en fonction d’une loi de défiscalisation (Pinel, LMNP) peut également être une bonne idée une fois la ville choisie.

Voici quelques aperçus sur les grandes villes de France, les plus prisées par les investisseurs.

Buying rental property in Paris

Réaliser un investissement locatif à Paris est une idée favorable, et ce, pour plusieurs raisons. Étant la capitale de la France, Paris restera toujours une destination obligatoire pour au moins 50 % des Français, qu’il s’agisse d’une année de passage ou pour y rester. Avec ses institutions prestigieuses, des grandes écoles et ses emplois diversifiés, on cherchera toujours à louer un bien à Paris, malgré la flambée des prix.

Property investment in Lyon

Lyon est la 2e région à faire le plus d’exportation en France, ce qui en fait un bassin de l’emploi tout à fait attractif. Elle est le siège de plus d’une centaine d’entreprises qui concentrent chacune au moins un millier de salariés. Une rénovation du quartier d’affaires de la Part-Dieu est prévue, créant ainsi de nouvelles opportunités d’emploi. La mise en place d’une gare capable d’accueillir plus de 200 000 personnes est également en marche. Ladite gare permet de se rendre à Paris en seulement 2 heures via le TGV et sera accessible d’ici 2030. Ajoutons à cela son cadre urbain, ses ruelles pavées, ses universités prestigieuses et ses nuits festives et cette zone devient l’une des métropoles préférées des Français. Ainsi, investir dans les quartiers de Lyon est une opportunité à ne pas rater pour effectuer un achat rentable et très facile à amortir.

Investing in a rental property in Marseille

Marseille est la 4e grande agglomération française où il fait bon d’investir. Le rendement immobilier de cette ville concourt avec ceux du centre de l’Hexagone. En effet, avec ses plages et ses calanques capables de faire rêver le monde entier, Marseille est une localité très demandée en matière immobilière. Avec 3 pôles de formation universitaire imposants, une bonne trentaine d’écoles spécialisées et d’instituts techniques, cette ville concentre plus de 80 000 étudiants. Enfin, son grand port maritime en fait un bassin d’emploi très attrayant. Point de passage du TGV depuis Paris, Marseille est richement desservie en transport, ce qui constitue une corde supplémentaire à son arc déjà bien doté.

Faire un investissement locatif à Bordeaux

Bordeaux constitue depuis peu le Paris provincial : de larges artères, des quartiers emplis de concept-stores et autres échoppes prisées, sa plage et ses appartements haussmanniens en font une ville désirable pour la plupart des Français. Pour 2030 on y prévoit l’arrivée d’un des plus grands projets d’aménagements du territoire français. Notamment, le quartier Euratlantique qui deviendra un nouveau bassin de l’emploi et de l’immobilier avec la construction de 25 000 logements et de nombreux commerces et enseigne du secteur tertiaire.

L’aménagement des environs de l’aéroport de Mérignac est également en prévision avec la création de pas moins de 35 000 emplois. De quoi augmenter le potentiel de cette localité pour les placements locatifs. Il faudra évidemment s’y prendre en amont de ces constructions afin d’éviter une hausse significative du marché de l’immobilier.

Investir dans un bien locatif à Lille

Lille dispose d’un emplacement privilégié car elle a l’avantage d’être située entre Paris, Bruxelles et Londres. Lille constitue ainsi une destination locative de choix pour les travailleurs parisiens, mais évidemment aussi pour les Lillois. Mais cette ville est aussi une destination de charme qui attire chaque année un flux de touristes impressionnants. Elle concentre également en son sein de nombreux sièges internationaux, mais également plus de 80 sièges nationaux, d’où la forte demande des habitants pour un appartement ou une maison. C’est également la 3e ville étudiante de l’Hexagone, et le 3e pôle de santé français.

Investing in rental property in Nantes

Nantes a toujours été parmi le top 3 du classement des villes les plus intéressantes pour les investisseurs locatifs. Pourquoi ? En raison de son faible pourcentage de chômage, de sa 1ère place dans l’industrie agroalimentaire, de son activité industrielle mais aussi de l’appétence de la communauté étudiante pour cette ville si festive. L'investissement locatif à Nantes est donc un projet à absolument envisager.

Opter pour l'immobilier locatif à Strasbourg

Les quartiers de Strasbourg constituent des localisations de choix pour les investisseurs immobiliers. Cette ville est considérée comme l’un des principaux pôles économiques du nord-est. Elle est composée essentiellement de secteur tertiaire tourné vers les activités financières et les conseils aux entreprises. Ces activités font de Strasbourg un lieu à fort potentiel pour un projet immobilier. Avec son université de grande renommée et ses grandes écoles, Strasbourg est aussi une ville étudiante constituée de 20 % d’étrangers.

Making a rental investment in Rennes

Rennes constitue la ville étudiante par excellence. Elle est la huitième parmi le classement des villes universitaires françaises et concentre plus de 70 000 étudiants, soit environ un tiers de sa population. On y dénombre deux campus et 12 grandes écoles qui feraient pâlir d’envie leurs consœurs parisiennes. Accessible depuis Paris en seulement 1 h 30, Rennes concentre les atouts en incarnant le siège de plusieurs grandes entreprises françaises et internationales. D’ici 2025, le projet EuroRennes sera terminé, lequel parie sur trois grandes dimensions : une nouvelle gare, le développement du pôle économique et l’extension du centre-ville.

Rental property investment in Toulouse

Toulouse est la ville FrenchTech de l’Hexagone. Elle abrite de très nombreuses industries et presque autant de startups, ce qui en fait une ville de choix dans laquelle investir. Toulouse est une ville dotée de nombreuses activités et autant de salariés et de collaborateurs en quête d’appartement. Avec son faible pourcentage de chômage, ses airs du sud et ses murs roses, on comprend aisément qu’elle occupe une place de choix dans le cœur des Français.

Investir dans un bien locatif à Rouen

Rouen est une ville d’histoire. Fief de la mise à mort de Jeanne d’Arc, elle a été très peu détruite au cours des deux guerres mondiales et comporte donc un quartier ancien singulier et important. Grace à ses prix stables et peu chers par rapport aux autres villes de la France, elle constitue une destination de choix pour un achat immobilier.

Rouen est également un cadre agréable sur l’axe Paris-Le Havre, à proximité immédiate de la capitale, accessible en 1 h 20 seulement par le train. Cette ville est également le siège de nombreuses entreprises nationales. Elle dispose aussi de plusieurs incubateurs de startups où prolifèrent les jeunes actifs en demande de logements. Enfin, de par sa quiétude et son nombre de bars, la ville attire de nombreux jeunes actifs.

Buying to rent in Metz

Ville lorraine à fort potentiel, Metz cumule les détails appréciables qui lui confèrent une qualité de vie exceptionnelle. Avec ses startups, ses technologies, son centre d’art contemporain qu’est Metz-Pompidou, et ses concepts stores, c’est une ville qui fait partie des plus branchées de l’Hexagone. Outre cette attractivité bien particulière, on y compte plus de 20 000 étudiants, et son technopôle accueille plus de 4 000 salariés répartis sur la télécommunication, les grandes écoles spécialisées et son centre d’affaires (Centre International du Congrès & World Trade Center Metz-Sarrebruck). On y trouve enfin le 6e port fluvial français et le 1er port céréalier. Ce sont des points forts pour votre investissement locatif Metz.

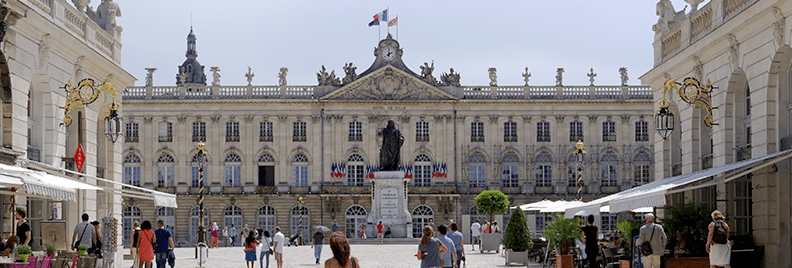

Réaliser un investissement locatif à Nancy

Avec plus de 50 000 corps estudiantins résidant en ville, Nancy est indubitablement l’une des plus imposantes en termes de communauté étudiante française. Avec un réseau universitaire d’exception regroupant l’École Supérieure d’Art et de Design, ICN Business School et Mines Nancy pour former un cursus prestigieux s’étalant sur plus de 10 hectares, cette ville constitue l’un des fleurons de l’éducation supérieure française. Aussi, la ville regroupe quasiment 70 % de locataires, ce qui crée une demande élevée en appartement. Avec un standing assez haut, les prix des loyers sont légèrement plus élevés que la moyenne, ce qui constitue une opération intéressante pour les investisseurs immobiliers. Située entre la France, l’Allemagne et le Luxembourg, Nancy est une ville où l’ouverture d’une entreprise est favorable, et c’est pour cela qu’environ 1 900 d’entre elles se développent pour atteindre un total de plus de 3 000 entreprises. Enfin, son cadre comprenant des places typiquement Lorraines et son aspiration pour la botanique en fait rêver plus d’un.

Envisager un investissement locatif à Reims

Avec sa prestigieuse Neoma Business School et Sciences Po, Reims, l’agglomération champenoise peut se targuer de compter plus de 35 000 étudiants. Accessible depuis la gare de l’Est de Paris en seulement 45 minutes, Reims cumule les qualités et accueille de nombreux salariés parisiens. Aussi, la ville compte environ 70% de locataires, avec évidemment, une forte demande locative.

Buying a rental property in Saint-Etienne

Saint-Étienne est la 5e ville étudiante dans le classement français. Elle accueille près de 30 000 étudiants, notamment en raison de sa proximité géographique avec Lyon, mais également grâce à ses 5 campus essentiellement spécialisés en science et en santé. L’agglomération compte également 4 grands pôles industriels et économiques : Viaméca, Sporaltec, un pôle de technologies médicales ainsi qu’un pôle dédié à l’eau et à l’environnement. Proche de Châteaucreux, cette ville bénéficie également de la population de salariés évoluant au cœur de sa cité des affaires qui comprend 250 000 mètres carrés de bureaux et du siège international du groupe Casino. Elle bénéficie d’un taux de rentabilité locative de 7,7% : ce n’est pas l’une des localités les plus demandées en matière de location, mais ses biens y sont peu chers et il est donc possible d’en tirer de bons profits à moindre coût.

Investing in rental property in Grenoble

Avec ses paysages montagneux, Grenoble est une ville où la qualité de vie est très appréciable et appréciée. Très ancrée dans la recherche sur les énergies renouvelables et la culture de la faune et de la flore, elle vient en tête des nombreuses métropoles de l’Hexagone. Avec ses grands pôles universitaires scientifiques et ses 150 grandes entreprises reconnues de par le monde, elle attire sans cesse des universitaires, des jeunes cadres, et également des collaborateurs plus expérimentés grâce aux niveaux de qualification particulièrement élevés qu’exige chacun des profils recherchés. Aussi, investir dans l’immobilier locatif à Grenoble c’est assurer d’accueillir de très nombreux candidats à la recherche d’appartement, de studio ou de maison dans le cadre de leurs études ou de leur travail. Grenoble est une véritable plaque tournante d’ingénieurs et de leader toujours à la recherche de qualifications supplémentaires et d’expériences hors du commun.

Rental investment in Montpellier

Idéalement située près des plages du Grau du Roi, de Palavas les Flots, ou encore de la Grande Motte, Montpellier est une ville extrêmement attractive. Si cette ville est appréciée pour son emplacement géographique, elle l’est également de par son centre-ville, bucolique et typique du sud de la France. Ruelles pavées, terrasse à perte de vue, et spécialités culinaires, elle cumule de nombreux points qui plaisent tant aux touristes qu’aux locaux. C’est sans compter son côté festif reconnu par l’ensemble du territoire. C’est sans surprise que Montpellier est composée par ¼ de population exclusivement étudiante, soit 70 000 environ. Côté professionnel, l’agglomération de Montpellier cumule 2 000 entreprises spécialisées en multimédia, en biotechnologies et en pharmaceutique réparties sur 18 grandes zones d’activité. Située au soleil avec un prix au mètre carré inférieur à 1 000 euros et une demande exponentielle, Montpellier constitue l’une des métropoles les plus favorables à l’investissement immobilier.

Investir dans l’immobilier locatif à Villeurbanne

Villeurbanne est une commune de la banlieue lyonnaise. Cette ville reste néanmoins l’une des localités françaises concentrant le plus de demandes locatives. Et pour cause, elle a de nombreux atouts, par exemple son campus concentrant 6 grandes écoles : polytechnique, l’Université Claude Bernard Lyon I ou l’INSA pour ne citer qu’elles. "Si les deux municipalités se rejoignent sur la probabilité élevée de profiter d'une plus-value à la revente du logement, elles s'opposent toutefois en termes de vacance locative, laquelle tend à être plus faible à Villeurbanne qu'elle ne l'est à Lyon...Enfin, force est de constater que ses prix, tant à l'achat qu'à la location, font que Villeurbanne attire aussi les Lyonnais à la recherche de logements familiaux.

Choisir d’investir dans l’immobilier locatif à Orléans

Idéalement située à moins de 150 kilomètres au sud de Paris, Orléans appartient maintenant à ce qu’il convient de nommer la banlieue étendue parisienne. Les salariés parisiens privilégient cette ville aux banlieues proches de par son cadre dynamique et son architecture qui ressemblerait à s’y méprendre à certains quartiers de la capitale. Avec seulement 1 h 14 de trajet en train, on comprend que certains la privilégient au profit de certaines communes d’Île-de-France bien moins desservies que la ville de cœur des rois de France. Avec plus de 113 000 habitants, Orléans présente un faible pourcentage de chômage à moins de 9 %, 5 000 entreprises et pas moins de 20 000 étudiants. La ville à elle seule produit plus de 70 % de l’intégralité des médicaments français et comporte donc un pôle pharmaceutique très imposant. Faciles à louer comme à revendre, ses biens immobiliers font des envieux parmi les travailleurs et les jeunes orléanais ainsi que les salariés parisiens.

Investir dans un bien locatif en Ile-de-France

On ne présente plus la région Ile-de-France et les avantages qu’elle présente pour un projet de location immobilière. Chaque ville constitue un excellent choix de localisation pour ses habitants, et au bas mot le “dortoir” idéal pour les emplois dans la capitale et dans la région. Comptant de très nombreux sièges nationaux et internationaux, de grandes écoles et les universités les plus courues du pays, l’Île-de-France est l’endroit où la vacance locative est la plus faible. Au cas par cas, chacune d’entre elles présente des avantages particuliers et des prix au mètre carré différents.

Choisir d'investir dans l'immobilier locatif à Nice

Située en plein cœur de la Provence-Alpes-Côte d’Azur, Nice est la 5e ville la plus peuplée de France. Il s’agit d’une métropole attractive, dynamique et ensoleillée qui propose un cadre de vie incomparable sur la célèbre Côte d'Azur. Grâce à son réseau de transport développé, la ville de Nice sait se rendre accessible, elle dispose même d'un aéroport international. Ville qui séduit les jeunes, près de 44 221 étudiants y poursuivent leurs études. Le marché de l’immobilier à Nice est en constante progression et y acquérir un bien immobilier s’annonce florissant pour les investisseurs en quête de rendement sur le moyen et le long terme.

Investir dans un bien immobilier locatif à Cannes

Située au cœur des Alpes-Maritimes, Cannes propose un cadre de vie de qualité. Ville de prestige en bordure de la mer Méditerranée, cette ville voit sa population tripler en période estivale. La demande locative y est très forte, ce qui est idéal pour un investissement immobilier locatif. Célèbre pour son fameux festival, les habitants et les touristes peuvent également venir profiter de La Croisette, de ses plages et de son magnifique panorama sur la mer Méditerranée. Attirant aussi bien vacanciers et retraités qu'hommes et femmes d'affaires tout au long de l'année, un investissement immobilier locatif à Cannes vous assurera un risque de vacance locative très faible.

Réaliser un investissement immobilier locatif à Toulon

Station balnéaire de la région Provence-Alpes-Côte d’Azur, Toulon se situe entre les villes de Nice et Marseille, entre mer et montagne, et jouit d’un taux d’ensoleillement élevé qui fait le bonheur de ses habitants. Destination touristique par excellence, cette ville connaît une forte demande locative, ce qui représente un atout indéniable pour investir dans l'immobilier. Premier port militaire de la Méditerranée, de nombreuses familles, étudiants et jeunes actifs s'installent dans la localité pour profiter de son cadre de vie agréable et de ses plages pittoresques. Grâce à un prix immobilier plus faible que celui des villes voisines, Toulon permet aux investisseurs d'obtenir un bon rendement locatif.

Choisir la ville de Caen pour son investissement locatif

Idéalement située proche de Paris, Rouen, Rennes et Le Havre, Caen jouit d’une position géographique stratégique à seulement 30 minutes de la mer. Caen attire chaque année un nombre important de touristes grâce à la richesse de son patrimoine historique et culturel d'exception. Caen accueille également de nombreux évènements culturels qui boostent son attractivité et son dynamisme tout au long de l'année. La commune est aussi l’une des plus anciennes villes universitaires de l’Hexagone. Outre l’Université de Caen-Normandie, elle abrite également plusieurs écoles supérieures. Autant d'arguments qui font de cette ville un lieu idéal où réaliser un investissement locatif.

Investir dans un bien locatif à Dax

Située dans le département des Landes, dans le sud-ouest de la France, la commune de Dax est connue pour être la première station thermale de France. La ville séduit un grand nombre de visiteurs de par ses paysages verdoyants et la diversité de ses activités. Elle a également l’avantage de se situer à proximité de grandes villes, comme Bordeaux. La cité dacquoise s’avère également un lieu très festif et animé. Bien située au cœur des Landes, sur la rive gauche de l’Adour, Dax est une ville dynamique. C’est pourquoi elle séduit les jeunes couples, les travailleurs, les cadres et les ouvriers. De plus, Dax est un pôle d’enseignement important. En effet, la ville héberge de bons établissements d'enseignement supérieur, comme l’Institut du thermalisme, l’école supérieure d’ingénierie informatique IN’TECH et l’Institut de formation en soins infirmiers (IFSI). C'est donc un endroit de choix pour un projet d’investissement locatif.

Faire le choix de Chambéry pour investir dans le locatif

Chambéry, également appelée la « Cité des ducs », est située au cœur du département de la Savoie, à mi-chemin entre Annecy et Grenoble. Ville à taille humaine, Chambéry attire de plus en plus d’investisseurs immobiliers français. Chambéry profite d’une variété de paysages exceptionnels combinant nature et urbanisme. Par ailleurs, la ville a de quoi faire plaisir aux amateurs de sports de glisse puisqu'il existe 7 stations de ski à proximité. En outre, le patrimoine et l’histoire ancienne de Chambéry lui ont permis d’être catégorisée « ville d’art et d’histoire ». Berceau de l’Université de Savoie, Chambéry est classée 1ère ville universitaire parmi les villes moyennes.

Réaliser son investissement locatif à Clermont-Ferrand

Située dans la région Auvergne-Rhône-Alpes, Clermont-Ferrand est une commune particulièrement attractive du centre de la France. Elle offre une multitude de possibilités pour effectuer un projet d’investissement locatif. La ville compte notamment près de 45 000 étudiants qui viennent y profiter de son calme. Outre son attractivité pour la communauté étudiante, la ville est également un excellent bassin d’emploi puisqu'elle abrite environ 23 833 entreprises. La ville de Clermont-Ferrand est considérée comme un pôle économique majeur de l’Hexagone et se classe parmi les meilleures villes en termes de dynamisme entrepreneurial.

Acquérir un bien immobilier locatif à Brest

Située à l’extrême pointe de la Bretagne, dans le Finistère, Brest attire de plus en plus d’investisseurs français. Cette ville réunit toutes les conditions pour réaliser un investissement rentable. Entre mer et terre, elle jouit d'une situation exceptionnelle. Alliant richesses naturelles et patrimoine culturel, cette localité attire chaque année un grand nombre de touristes qui viennent y profiter des belles plages, du conservatoire botanique, du musée national de la marine ou bien encore de la tour Tanguy. Premier bassin d’emploi du département du Finistère, Brest est aussi le principal pôle économique de la région Bretagne. Par ailleurs, la commune recense actuellement près de 26 000 étudiants, attirés par la modernité des infrastructures et la qualité de vie offerte par la ville.

Investir dans l’immobilier locatif à Vannes

Vannes est idéalement située sur la côte sud de la région Bretagne. Disposant d’un cadre de vie calme et agréable, elle attire particulièrement les familles, les étudiants et les séniors. Ville touristique, Vannes affiche un très bon climat économique, un bon développement démographique et une bonne couverture logistique. Ces qualités en font notamment une commune idéale pour effectuer un investissement dans l’immobilier locatif. Outre la présence du port, Vannes dispose de plusieurs monuments. Les habitants peuvent notamment découvrir les remparts et le jardin de la Garenne ou bien la cathédrale Saint-Pierre de Vannes. De plus, Vannes est particulièrement attractive grâce à sa qualité de ville verte. Ainsi, investir son argent dans cette ville vous offrira un bon patrimoine pour le futur en plus de vous générer des revenus complémentaires.

Investir dans la ville de Quimper

Commune française de la région Bretagne, Quimper est propice à l’investissement immobilier. Outre son réseau de transport et son développement démographique, elle offre également différents services indispensables pour un cadre de vie agréable. Quimper propose notamment divers marchés, restaurants et centres de loisirs. De par son patrimoine historique exceptionnel et ses nombreux parcs, elle a obtenu le label « 4 fleurs » au concours des villes et villages fleuris. Également connue comme une ville touristique, Quimper possède un centre-ville bien animé et se trouve à proximité de la plage. De plus, le cœur de la ville attire énormément les étudiants, contribuant ainsi à alimenter la demande locative.

Choisir d'investir dans la pierre au Havre

Située en région Normandie et abritant l’un des deux plus grands ports français, Le Havre bénéficie d'une forte attractivité aux yeux des investisseurs. Disposant d'un patrimoine riche, elle fait partie des sites français inscrits au Patrimoine Mondiale de l'UNESCO depuis 2005. En outre, la ville jouit d'une forte accessibilité grâce à sa situation géographique idéale. Niveau déplacement, les habitants profitent de nombreux moyens de transport efficaces et variés. Le Havre compte notamment 22 lignes de bus et 23 stations de tramway. Par ailleurs, la commune attire de nombreux étudiants notamment grâce à l'Université Le Havre Normandie. Pour les familles, la ville compte également plusieurs dizaines d'écoles primaires, maternelles, de collèges et de lycées. Ainsi, c'est un secteur bénéficiant d'une forte demande locative ce qui est idéal pour y réaliser un projet immobilier rentable.

Où investir : choisissez des grandes villes !

Les grandes métropoles semblent être une valeur sûre en termes d’investissement immobilier locatif. Néanmoins, avec le temps, et malgré des vacances extrêmement faibles, certaines localités voient leurs prix s’envoler et créer un rendement beaucoup moins intéressant. Effectivement, le loueur aura toujours énormément de demandes, mais le prix auquel il aura acquis le bien sera bien plus long à amortir, même avec des loyers plus hauts que la moyenne.

D’une manière ou d’une autre, il y aura toujours un quartier plus attrayant que d’autres en fonction des besoins de chaque client. Aussi, la demande sera toujours plus forte dans certains quartiers des métropoles comme Paris ou Marseille, le prix d’un loyer baissera de près de 200 euros si tant est qu’on change de trottoir. C’est pourquoi il est toujours important de connaître la ville dans laquelle on s’apprête à acheter un bien avant de passer aux actions.

Si les métropoles constituent un investissement locatif optimal pour un achat d’appartement, de maison ou de studio, les municipalités moyennes aux alentours gagnent également à être connues. En effet, leurs petits prix, leur proximité avec les grandes localités, et leur qualité de vie sont des arguments de poids qui leur confèrent un faible pourcentage de vacances locatives. Évidemment, les localités les mieux desservies par les transports en commun constitueront l’Eldorado des investisseurs. En effet, ces villes seront largement recherchées par les locataires.

- Mickael Zonta

- Rental Investment Director

A graduate of a major business school, and after a first successful experience in finance, Mickael Zonta began his career in real estate in 2011 in Paris before extending his activity to the Paris region and the city of Lyon. The fact that he is also a real estate investor in a personal capacity allows him to understand clients' issues in terms of investment objectives, rental yield and choice of tax regimes.

Our latest achievements

-

![le-havre/76/le-havre-t1-bien-rare]()

- Studio

- 135,000 €

- 9.03 %

- Le Havre

Investissement locatif réalisé à Le Havre avec vue sur la mer - T1

-

![paris/12eme-arrondissement/studio-en-t2]()

- Studio

- 296,000 €

- 5.06 %

- Paris 12

Investissement locatif réalisé Paris 12ème - Studio en T2

-

![parisian-region/montreuil/spacious-studio]()

- Studio

- 198,000 €

- 4.85 %

- Montreuil

L'investissement locatif d'un T1 réalisé par Thomas à Montreuil

Success stories from our investor customers

Our greatest pride is your renewed trust! More than 2 out of 3 clients go on to one or more other projects. Find out why...

-

![Investor Testimonial Carthery]()

Benoit CARTHERY

Paris Region"I would like to share here my experience with the investment-locatif.com company, to reassure people who are not familiar with the concept I call: "they take care of everything, you take care of nothing 😊". Well almost nothing, you just have to ask your bank for the loan 🏦(...) I can't wait to start a new project with them.

Perfect 5/5

-

![Investor Testimonial Carthery]()

Vincent Alagille

Paris Region"(...) The support and the follow-up of the project are done by a dynamic, professional and pleasant team. The various impediments are quickly overcome thanks to the efficiency of the staff. It's confusing how easy it is to invest with Investissement Locatif! I HIGHLY RECOMMEND.

Perfect 5/5

-

![Investor Testimonial Carthery]()

Gaby Taverny

Paris Region"(...) I was convinced by the services offered by Investissement-locatif.com (...) The deadlines announced at the beginning of the project were respected, a fact that is worth emphasizing. The service was clearly up to my expectations. The attention of the various players throughout the process was an important part of the project. Communication is key. Moving on to the second project ...!!!!!

Perfect 5/5